This page is purely informational.

There are no actionable resources here which would enable lawbreaking.

Know Your Customer (KYC) and identity verification platforms have become essential in finance, crypto, e-commerce, and regulated industries. These systems confirm user identities through document checks, biometrics, and data cross-referencing to fight fraud, money laundering, and underage access. Providers like Regula Forensics, Veriff, AU10TIX, Persona, and Resistant AI dominate the market with databases covering thousands of ID templates from hundreds of countries. Put simply, you’ve got to know who your dealing with. But sometimes those customers, well, they don’t want to tell you who they really are.

Artificial intelligence drives rapid evolution on both sides of this battle. Criminals use AI to generate convincing fake IDs, while verification platforms deploy AI to detect them — it’s one battle after another.

Generative AI has lowered the barrier for creating forged documents. Tools like Stable Diffusion or specialized services produce realistic driver’s licences, passports, and utility bills in minutes. Underground markets sell “OnlyFakes”-style AI-generated ID sets for $30–$700, complete with matching selfies and videos.

Deepfakes take this further with injection attacks or pre-recorded videos that mimic liveness checks. Reports show AI-generated IDs bypassing major crypto exchanges and traditional KYC providers (KYC360, Thistle Initiatives). Fraudsters exploit high-value sectors like banking and mobility, where document fraud rates reach 24% in financial services (SmartSearch).

Verification platforms counter with advanced AI. They analyze pixel-level anomalies, lighting inconsistencies, and motion artifacts in deepfakes (GBG, LSEG). Passive liveness detection checks depth, texture, and micro-expressions without user action.

Active liveness challenges require users to tilt their head, smile, or read random words on camera to defeat pre-recorded videos. Document checks cross-reference extracted data against independent databases and flag inconsistencies (Kaspersky).

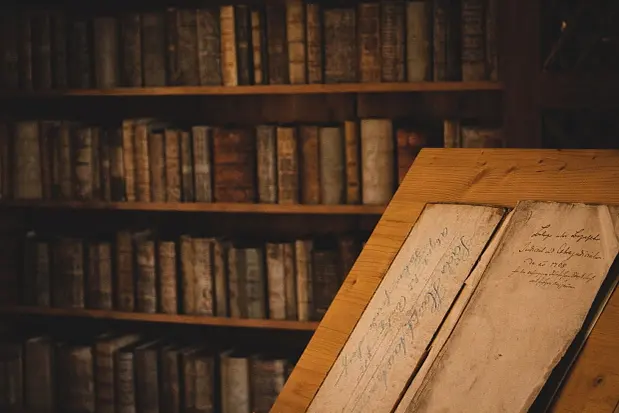

AI is great at digital fakes but not so great with physical documents. Criminals can’t perfectly reproduce tactile elements like raised text, laser engraving, microprinting, or UV-reactive inks that change under light. Holograms require industrial machinery, and polycarbonate layering with embedded chips remains extremely difficult to mimic at scale.

Even high-end forgers miss subtle details like correct laminate texture or precise perforation patterns. These physical limitations give verification platforms a lasting advantage when combining digital analysis with real-world forensic checks (AiPrise, VerifyOnline).

The future of KYC lies in layered defences: AI-powered document and biometric verification, backed by database cross-checks and human review when needed. As generative AI improves, so do detection methods — but the physical world’s complexity ensures no fake will ever be perfect.